Why Companies Issue Stock

Learn why companies choose to go public and sell shares to investors.

Learning Objectives

- Understand why companies need to raise capital

- Learn what an IPO is and how it works

- Identify the benefits and drawbacks of going public

- Recognize how this creates opportunities for investors

Why Companies Issue Stock#

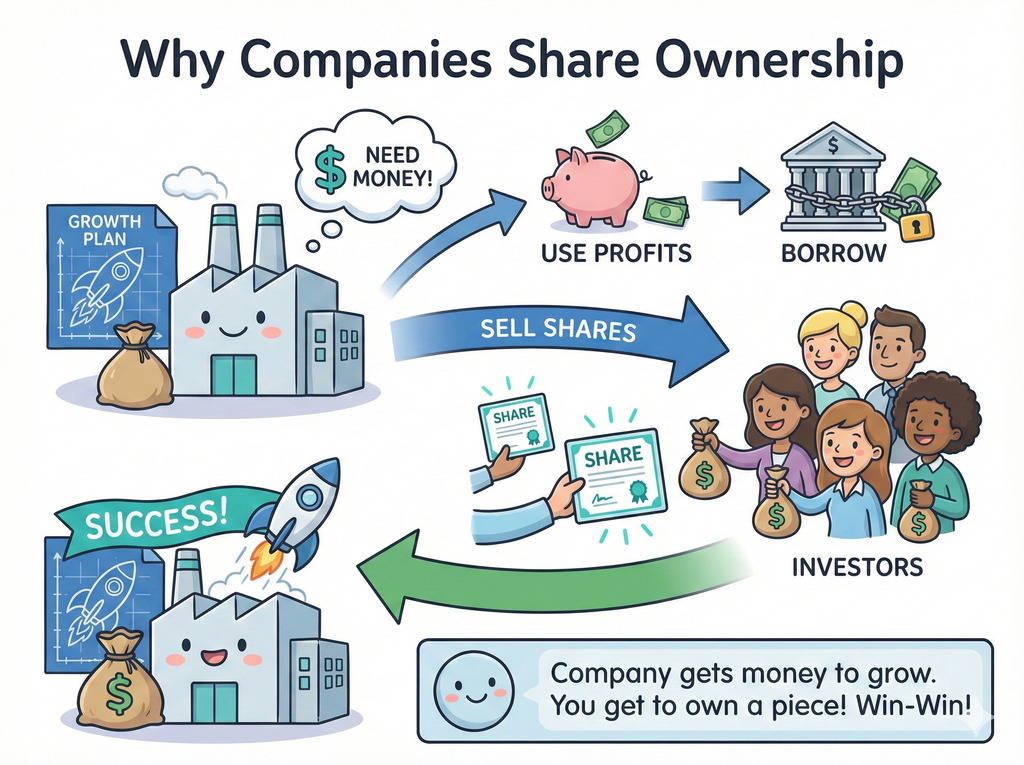

Every major company you know today, from Apple to Amazon, made a pivotal decision at some point: to sell ownership shares to the public. But why would a company want to share its ownership and future profits with strangers? Understanding this helps you see stocks from both sides of the equation.

Companies issue stock primarily to raise capital, money they can use to grow the business, fund new projects, or pay off existing debts.

The Need for Capital#

Running and growing a business requires money, lots of it. Companies need capital for:

| Purpose | Example |

|---|---|

| Expansion | Opening new locations, entering new markets |

| Research & Development | Creating new products or improving existing ones |

| Equipment & Technology | Buying machinery, upgrading systems |

| Hiring | Recruiting talented employees |

| Acquisitions | Buying other companies |

| Debt Reduction | Paying off loans to reduce interest costs |

Ways Companies Can Raise Money#

Before issuing stock, companies have other options to raise capital:

1. Borrow Money (Debt)#

Companies can take out loans or issue bonds. However, debt must be repaid with interest, which creates ongoing financial obligations.

2. Use Profits#

Companies can reinvest their earnings. But this limits growth to whatever profits the company generates, which may be slow for newer businesses.

3. Sell Ownership (Equity)#

Companies can sell shares of stock, trading ownership for capital. This is where you, as an investor, enter the picture.

Key Difference

Unlike loans, money raised through stock doesn't need to be paid back. However, the company is now sharing future profits with shareholders.

The IPO: Going Public#

When a private company decides to sell stock to the public for the first time, it conducts an Initial Public Offering (IPO).

How an IPO Works#

- Decision: Company decides it needs significant capital and wants to go public

- Preparation: Hires investment banks to help value the company and prepare documentation

- SEC Filing: Files required paperwork with the Securities and Exchange Commission

- Roadshow: Executives pitch the company to large investors to gauge interest

- Pricing: Sets an initial share price based on demand

- Trading Begins: Shares start trading on a stock exchange

Famous IPO Examples#

- Apple (1980): Raised $100 million, now worth over $3 trillion

- Amazon (1997): Went public at $18/share, early investors saw massive returns

- Google (2004): Innovative "Dutch auction" IPO at $85/share

Benefits of Going Public#

For companies, issuing stock offers several advantages:

Access to Capital: Raise large amounts of money without taking on debt

Liquidity for Founders: Early investors and founders can sell some shares and realize gains

Currency for Deals: Public stock can be used to acquire other companies

Prestige and Visibility: Being publicly traded increases brand recognition and credibility

Employee Incentives: Stock options become more valuable when employees can eventually sell shares

Drawbacks of Going Public#

It's not all upside. Companies face challenges when they go public:

Loss of Control: Founders must answer to shareholders and a board of directors

Disclosure Requirements: Must publicly report financial results and business details

Short-term Pressure: Pressure to meet quarterly earnings expectations

Costs: IPO process is expensive (legal fees, underwriting costs, ongoing compliance)

Vulnerability: Public companies can be targets for activist investors or hostile takeovers

Reality Check

Not every IPO is a success. Some companies see their stock prices fall below the IPO price, and investors can lose money. Recent history has many examples of hyped IPOs that disappointed.

What This Means for You#

As an investor, IPOs create opportunities to own pieces of growing companies. When you buy stock:

- The company already received the capital (from the IPO or later stock offerings)

- You're buying from other investors in the "secondary market"

- Your purchase price goes to the seller, not the company

However, when companies do well:

- Their stock price typically rises

- You benefit from that price appreciation

- Some companies share profits through dividends

This alignment of interests, where company success benefits both the business and its shareholders, is what makes stock investing work.

Key Takeaways

- Companies issue stock primarily to raise capital for growth and operations - An IPO (Initial Public Offering) is when a company first sells shares to the public - Going public provides capital access but comes with disclosure requirements and pressure - Investors benefit when companies they own shares in succeed and grow - The stock market creates a win-win: companies get funding, investors get ownership opportunities